Date: Fri Mar 06 2009 - 13:26:53 EST

[graphs are attached, JL]

Worse than the Great Depression.

by Dr. Krassimir Petrov

The mainstream media and

Wall Street have reached the consensus that the current credit crisis is

the worst since the post-war period. George Soros' statement that

"the world faces the worst finance crisis since WWII" epitomizes

the collective wisdom. The crisis is currently the ultimate scapegoat for

all the economic evils that currently plague the global financial system

and the global economy - from collapsing stock markets of the world to

food shortages in third world counties. We are repeatedly assured that the

ultimate fault lies with the Credit Crisis itself; if there were no Credit

Crisis, all of these terrible things would never have happened in the

economy and the financial markets.

The most extraordinary

thing is that the mainstream media has never attempted to compare the

current economic environment to the one preceding the Great Depression. In

essence, it is assumed outright that the Great Depression can never

possibly happen again, ever, thus obviating the need for such a

comparison. I actually believe that the macroeconomic fundamentals today

are much worse, so that we are in for a protracted period of economic

depression - a depression much worse than the Great Depression, a

depression that would likely be remembered in history as "The Second

Great Depression" or The Greater Depression, as Doug Casey has called

it so aptly. Here is why I believe that this is the case.

Duplicating Mistakes from the Great Depression

At its core,

the environment of the 1990s, and the response of the Fed to the

tech-telecom bust has created an economic environment that has encouraged

the repetition of the very same mistakes that led to the Great Depression.

Here is a concise summary of widely recognized mistakes of the 1920s,

without going into the details, with obvious parallels in the current

environment:

a.. Asset Bubbles - first in the stock market

during the 1990s, then in real estate during the 2000s, pretty much

mirroring the stock and real estate market bubbles of the 1920s.

b..

Securitization - although not in the very "ultra-modernistic"

form and shape of the 2000s, with slicing and dicing of pools and tranches

of seniority, it was widely recognized in the 1930s that securitization

during the 20s drove the domino effect in the U.S. financial system during

the Great Depression.

c.. Excessive Leverage - just like in 2008 the

topic du jour is "deleveraging", so the unwinding of leverage

during the 1930s was the driver of forced liquidations and financial pain.

Of course, it was very clear back then that the root of the problem was

not deleveraging per se, but the excessive leverage that took place prior

to the deleveraging process. "Investment Pools" were then

instrumental in both the securitization and excessive leverage, just like

the Hedge Funds of today.

d.. Corrupt Gatekeepers - we know well

that the Enrons and Worldcoms were aided and abetted by the accounting

firms - those same firms that were supposedly the Gatekeepers of the

financial community, yet handsomely profited from the boom while

neglecting their watchdog functions. In the current financial crisis, we

also know that the rating agencies were also making hay during the boom.

Very similar were the issues during the 1920s that led to the

establishment of the SEC and other regulatory bodies to replace the

malfunctioning "gatekeepers" at the time.

e.. Financial

Engineering - we are led to believe that financial engineering is a rather

recent phenomenon that flourished during the New Age Finance Era of the

last 15 years, yet financial engineering was prevalent in the 1920s with

very clear goals: (1) to evade restrictive regulations, (2) to increase

leverage, and (3) to remove liabilities from the books, all too familiar

to all of us today.

f.. Lagging Regulations - just like the

regulatory environment lagged the events of the 1920s and regulations were

introduced only after the Great Depression had obliterated the U.S.

financial system, so we are yet to see new regulations addressing the

causes of the current crisis. Understandably, regulations should have

foreseen today's financial problems and should have been introduced before

the crisis.

g.. Market Ideology - back in the 1920s, just like in

the last two decades, the market ideology of "laissez faire",

which Soros quite appropriately described as "Market

Fundamentalism", has swept the financial markets. Of course, the free

market knows the best, but the reality is that the money market is not

really free - when the Fed determines the cost of money (interest rates),

and can fix this cost for as long as it wants, then all sorts of financial

imbalances can be sustained without the discipline imposed by the market.

This can lead to all sorts of problems that we actually have to face

today.

h.. Non-Transparency - back in the 1930s, it was widely

recognized that businesses and especially financial institutions lacked

transparency, which allowed for the accumulation of significant imbalances

and abuses. Today, financial markets and institutions have intentionally

compromised transparency in a number of ingenious, or better disingenuous,

accounting trickeries and financial gimmicks, like off-balance-sheet

entities (SIVs), hard-to-understand derivatives, and opaque instruments

with mind-boggling complexity. Today CEOs and Chief Risk Officers of major

financial institutions cannot figure out their own risk exposures.

Originally, lack of transparency was designed to fool the markets;

ironically, modern-day financial executives have gotten to the point of

fooling themselves.

Worse than the Great Depression

So,

why Worse Than The Great Depression? What makes me believe that the

current depression will be worse than the Great Depression? I present six

of the most important fundamentals that are "baked in the cake"

and that suggest of a Greater Depression.

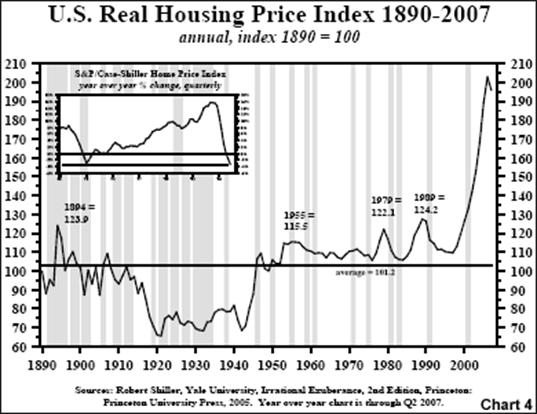

1.. Overvalued Real

Estate. The real estate market has been driven by a number of innovations

in real estate finance. Overvaluation in real estate implies overvaluation

in real estate financial instruments; an implosion of real estate prices

implies an implosion in those instruments. It is widely recognized by

economists that the Case-Shiller Index is a good proxy for the prices of

real estate. A widely-recognized chart from 1890 to 2007 tells the story.

The chart makes it crystal clear that the current overvaluation of real

estate in real terms grossly exceeds the one during the 1920s. The coming

correction in real estate will be protracted and gut-wrenching, with an

expected cumulative effect that is much worse than the Great Depression.

.

2.. Total U.S. Credit. Credit makes leverage: the more

credit in the financial system, the more leveraged it is. Today's total

U.S. credit relative to GDP has surpassed significantly the levels

preceding the Great Depression. Back then, the total amount of credit in

the financial system almost reached an astonishing 250% of GDP. Using the

same metric today, the debt level in the U.S. financial system surpassed

350% in 2008, while the level in 1982 was "only" 130%. As

Charles Dumas from Lombard Street Research put it quite aptly, "we've

had a 30-year leveraging up of America, ending in an unchecked orgy."

The chart below shows a dramatic buildup of debt (leverage) in

the 1920s and a deleveraging from 1930 to 1945 (or 1952). Then it shows a

consistent buildup of debt afterwards, with a dramatic rise since the

1990s, and surpassing in 2000 the previous peak in 1929. The chart shows

the level of 299% at the end of 2005, but the level has already reached

350% by 2008.

Of course, leveraging, as already

indicated above, must necessarily be followed by deleveraging.

The best way to think about leverage is to compare it with using drugs,

while deleveraging is like detox. The problem is not that the detox is

killing the patient who has abused drugs for years; what is really killing

the patient is the drug abuse itself. However, one thing is clear - the

patient must either go through a painful detox or die; the same applies

for the financial system - it must either deleverage or implode.

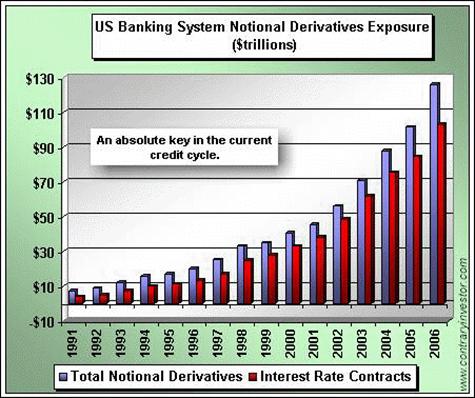

3..

Explosion of Derivatives. Derivatives have been likened by Warren Buffet

to "financial weapons of mass destruction". The notional amount

of total derivatives, as well as "Value at Risk" (VaR), has

skyrocketed in recent years with the potential to destabilize the

financial system for decades. To put it more allegorically, derivatives

hang like a sword of Damocles over the financial system.

A

comparison with the 1920s is difficult to make. mostly Derivatives back

then were extensively used, although not widely understood. Given that I

am not aware of any statistics of derivatives for the period of the 1920s,

a meaningful comparison based on hard data is admittedly impossible.

Nevertheless, I would venture to make an intelligent guess that the size

of modern-day derivatives is hundreds or even thousands of times larger

relative to the size of the economy in comparison to the 1920s. Some of

the latest reports indicate that the total notional value of derivatives

outstanding surpasses one quadrillion dollars. To put this into

perspective, this amounts to almost 100 times the GDP of the U.S. economy.

The chart below shows the explosion of derivatives in the U.S.

banking system. You can see that in 1991 the notional value of the

derivatives was about the size of the U.S. GDP. By 2006 the size has grown

to about 10 times the GDP, vastly outgrowing the real economy.

The chart below shows an even more telling picture. It

shows world GDP and world's notional value of derivatives. Again, while

there is no direct comparison with the 1920s, it is clear that the overall

level of derivatives has skyrocketed during the last two decades and

presents risks that were simply not present at the onset of the Great

Depression. The unwinding of these derivatives could only be compared with

a nuclear explosion in the financial system.

4..

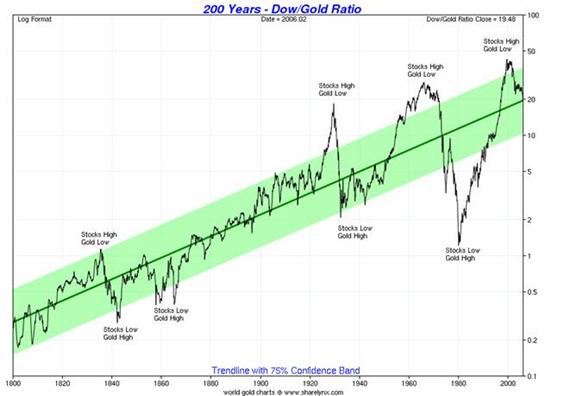

Dow-Gold Ratio. The Dow-Gold ratio represents the most important ratio

between the relative prices of financial assets and real assets. The Dow

component represents the valuation of financial assets; the gold component

- of real assets. When leverage in the financial system increases

significantly, so does this ratio. A very high ratio is interpreted as an

imbalance between financial and real assets - financial assets are grossly

overvalued, while real assets are grossly undervalued. It also implies

that a correction eventually will be necessary - either through deflation,

which implies deleveraging and a collapsing stock market, or through

inflation, which implies stagnant stock market for many years and steadily

rising prices of real assets, commodities, and gold, usually associated

with stagnant economy and typically resulting in stagflation. The first

case-deflation-occurred during the 1930s, while the second

case-stagflation-occurred during the 1970s.

The graph below

illustrates the above concepts. The very high Dow-Gold Ratio in 1929 was

followed by the Great Depression, while the higher level in 1966 was

followed by the stagflationary 70s. It is evident from the chart the peak

in 2000 surpassed the previous two peaks in 1929 and 1966, so this

provides a reasonable expectation that the forthcoming return to

"normalcy" will be more painful than the Great Depression, at

least in terms of cumulative pain over the next 10-15 years.

5.. Global Bubbles. It is impossible to make direct comparison

with the 1920s, but today the global economy is rife with bubbles. Back

then in the 1920s, the U.S. had its stock and real estate bubbles, while

the European economies were struggling to rebuild from the devastations of

WW1 that ended in 1919. I am personally not aware of any other bubbles

during this period, although I welcome reader feedback on this topic.

Today the picture is very different. The U.S. economy had a stock

market and real estate bubble that has surpassed its own during the 1920s.

Colossal US current account deficits have fuelled extraordinary growth in

global monetary reserves. As a result, Europe has real estate bubbles

across the board, from the U.K. and Ireland, throughout the Mediterranean

(Spain, France, Italy and Greece), to the entire Baltic region (Latvia,

Lithuania, and Estonia) and the Balkans (Romaina and Bulgaria). Even

worse, many Asian countries (China, Korea, etc.) also have their own stock

and property bubbles, only with the exception of Japan, which is still in

the process of recovering from its own during the 1980s. Thus, during the

1920s only the U.S. suffered from gross financial imbalances, while today

the imbalances have engulfed the whole world - both developed and

developing. It stands to reason that the unwinding of those global

imbalances is likely to be more painful today than it was during the Great

Depression due to both size and scope.

6.. Collapsing Bretton Woods

II. The global monetary system was on a quasi-gold standard during the

1920s. Back then dollars and pounds were convertible to gold, while all

other currencies were convertible to dollars and pounds. An appropriate

way to think about it is that of a precursor to the Bretton Woods from

1945-1971. What is important to understand is that while the system was

fiat in nature, gold imposed significant limitations to credit expansion

and leveraging.

Somewhat similar was the role of Bretton Woods

that lasted from 1945 to 1971. The dollar was tied to gold, while all

other fiat currencies were tied to the dollar. Just like the interwar

period, gold imposed some limitations on credit and financial imbalances.

We now live in what has been termed Bretton Woods II.

Essentially, this is a pure fiat dollar standard, where all currencies are

convertible to dollars, either at fixed or floating exchange rates, while

the dollar itself is convertible to "nothing". Thus, the dollar

has no limitations imposed to it by gold, so without the discipline of

gold, the current global monetary system has accumulated significantly

more imbalances than ever before in modern capitalism. These imbalances

show up in the international monetary system as unsustainable trade

deficits (and surpluses), skyrocketing official dollar reserves in some

European and many Asian central banks, and the proliferation of Sovereign

Wealth Funds; more generally, these imbalances result in a myriad of

bubbles, overleveraging, and other maladjustments already discussed above.

Today Bretton Woods II is in the process of disintegration.

The world is slowly but steadily losing its confidence in the dollar as

the world reserve currency. A flight from the dollar is in progress and

the collapse of the global monetary system is imminent. As Bretton Woods

II disintegrates and a new system replaces it, the process of readjustment

will be necessarily more painful than the respective process during the

Great Depression.

A caution on terminology is necessary here.

While the literature over the last 10-20 years has widely recognized the

term "Bretton Woods II", in September-October of 2008 the term

was widely used by the media to describe a proposed international summit

with the goal of reconstructing a new international monetary system

designed from scratch, just like "Bretton Woods". Instantly

dubbed by the media "Bretton Woods II", this term could be

potentially very confusing as it could mean very different things to

different people. The interested reader should consult Wikipedia's Bretton

Woods II where both meanings are explained in detail.

Conclusion

Since August of 2007 we have witnessed the relentless escalation

of the credit crisis: a steady constriction of credit markets, starting

with subprime mortgage-backed securities, spreading to commercial paper,

then to interbank credit, and then to CDOs, CLOs, jumbo mortgages, home

equity lines of credit, LBOs and private equity markets, and then

generally to the bond and securities markets.

While the media

describes the problem as one of illiquidity and confidence, a more serious

analysis indicates that boom-time credit has been employed unproductively

and so losses must be incurred. In other words, scarce capital has been

misallocated, poorly invested, and effectively wasted. No amount of

monetary or fiscal policy can fix the errors of the past, just like no

modern treatment can quickly restore to health a drug addict debilitated

from a decade-long drug abuse.

Based on indicators like (1)

global real estate overvaluation, (2) indebtedness, (3) leverage, (4)

outstanding derivatives, (5) global bubbles, and (6) the precariousness of

the global monetary system, I would argue that the accumulated imbalances

in the current period surpass significantly those preceding the Great

Depression. I therefore conclude that the coming U.S. (and possibly)

global depression will be of greater magnitude than the Great Depression

of the 1930s. It likely suggests that we are entering a historic period

that will likely be known as The Greater Depression.

Investor

beware! Only gold can protect you from the ravages of another Depression!

_______________________________________________

ope mailing list

ope@lists.csuchico.edu

https://lists.csuchico.edu/mailman/listinfo/ope