From: Paul Cockshott (wpc@DCS.GLA.AC.UK)

Date: Mon Oct 01 2007 - 09:16:38 EDT

________________________________

>

> However the factor that Steindl focused on was the

> tendancy for the gearing

> ratio of industrial capital to rise, and thus for

> the amount of retained profits

> to fall. He argued that this can result in lower

> rates of accumulation.

> This cause is independent of the rate of interest

> since a higher gearing

> ratio means, at any given rate of interest, the rate

> of profit of enterprise

> will be lower.

________________________

But what those people who are getting high rate of

interest are doing with it? The problem with this

story is that it does not have a theory of interest.

What determines the rate of interest?

______________________

The ideas I am arguing here were developed in a paper written

Some years ago here : http://www.dcs.gla.ac.uk/~wpc/reports/realc/realc.pdf

But let me try and summarise:

1. What are people with a high rate of interest doing with it?

This amounts to asking what does the rentier class do with its income?

I would go along with Keynes and assume that they save a relatively high proportion of it. Since the total

of net new saving must equal the total net new borrowing, this saving by the rentier class imposes

an external constraint on the rate of growth of net enterprise debt, unlesss that is, the rentier class

choses to save primarily in equities. Suppose that the rate of issue of new equities does not rise,

and this is realistic at times when interest rates are high, since this depresses equity prices,

then the effect of rising interest rates is to increase the rate of growth of the gearing ratio.

This rise in the gearing ratio is, from the standpoint of the banking system, a rise in the mass of

loans and by the recirculation of funds, a rise in the mass of deposits. But what this means is that

the ratio between bank liabilities ( deposits ) and first class assets ( state money ) changes. The

first class assets fall as a share of total reserves, whilst second class assets ( commercial debt )

rises.

2. What is my theory of the rate of interest?

Well I have now reached the point in the explanation to bring this in. I believe that the rate of

interest will be a rising function of the ratio of second class to first class assets held by the

banking system. A bank with a low reserve ratio faces an increased probability of facing a run on

its deposits, or even, of not being able to meet normal random fluctuations in the withdrawal to

deposit rate. If that happens the capital of the bank is at risk. Thus as a bank's reserve ratio

falls, the potential cost of making a loan rises, and the bank will demand a higher interest rate

for any loans that it makes.

During the gold standard, the first class reserves were exogenously determined by the gold mining industry,

and the commericial crises of the period came whenever the tendency for the gearing ratio to rise

hit the buffers set by the gold reserves. Nowadays, the first class reserves are denominated in

state money, which is a very variable standard of value indeed, and one which can be expanded at will

by the central bank.

We saw this process in operation very clearly in the run on the Northern Rock bank in the UK last month.

The banking system as a whole had an excessive ratio of second and third class assets to liabilities,

and Northern Rock had a position that was aggravated by the fact that its liabilities were, to an

unusually large extent in the form of term loans from other banks, whereas its assets were in the form

of relatively illiquid mortgages. The rate at which it could borrow on the interbank market became

prohibitive so it was forced to go to the central bank. In order to control the interest rate, and

keep the Northern Rock liquid, the central bank was forced to extend an extra £10 billion in loans.

The central bank now controls the interest rate, but in doing so, it must adjust the level of

Primary assets held by the banking system to the level which, in the absence of state intervention,

would induce the desired rate of interest.

Ajit writes

____________________

But wouln't it be crazy for the capitalists to

continue to invest if their rate of profits is lower

than the going rate of interest? Remember, the story

is about the long-term trend, so these capitalists

will have to be simply crazy.

____________________________

You misunderstand me. What I am saying is that those capitalists who

currently earn less than the rate of interest tend to become rentiers,

since it is more advantageous for them to lend out their capital

than to accumulate it productively.

The combination of a fluctuating real interest rate and

a normal distribution of the profit rate induces a polarisation

of the 'gas' whose molecules are individual capitals.

_________________________

I'm not convinced. Let's leave the question of C/V

aside. Unless you have a theory of barier to growth,

as long as techniques remain the same, why should the

rate of profits fall. And why should technology become

less efficient, unless you have some kind of

diminishing returns. So the fall in the rate of

profits must be explained by rise in wages.

________________________

Again I would explain this by dropping the assumption

Of a degenerate distribution of the rate of profit.

I would assume

a) that the regulator of investment is not the rate of profit

as assumed by Okishio but the rate of interest.

b) that there is not a single rate of profit but a normal

distribution thereof.

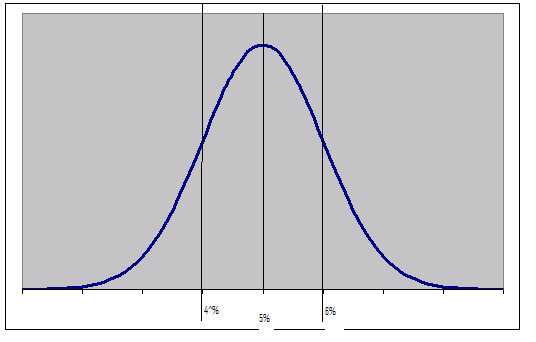

Consider the following diagram showing a PDF of the profits experienced by capitals.

Suppose that Ricardian conditions of production constrain the Long term profit rate to be 5%, but that at different points, due to monetary fluctuations the rate of interest moves so that at one point it is 4% at another - say during a commercial crisis it is 6%.

In general all capitals to the right of the vertical line representing the rate of interest will find it profitable to invest in new Constant capital. When the rate of interest is low, then firms even those whose rate of profit is below the average rate of profit, will find it worth while to accumulate. The mean rate of profit will therefore no longer act as a barrier to further investment as argued by Okishio, and accumulation which raises the organic composition will take place.

We know that there have been historical periods in which such a rise in the capital/labour ratio has occurred, which Okishios theorem should have inhibited. This provides an explanation of how it can have happened.

Note that this fits in with your results about the profit rate.

>

> It depends on where the unproductive workers are

> employed.

> If they are just personal servants, yes it has no

> effect

> on profit, since they are paid out of distributed

> profits.

> If on the other hand they are advertising and

> sales staff for example, their wages appear in the

> accounts

> like any other employee even though, in aggregate,

> from

> the standpoint of the whole economy, they are

> unproductive.

> They will thus tend to lower the rate of profit by

> increasing the wage bill prior to profit being

> calculated.

_______________________

This is an interesting point, which I hope you could

develop further. This could be your new source of

diminishing returns. But you will have to explain why

this source of cost must increase proportionately more

as output rises. One may expect that with rise in

output, the share on ad. etc. may fall. But there is a

theoretical potential here in trying to work it

through monopolistic or oligopolistic competitive

models.

I agree that theoretical work is needed, but empirical work

On the UK over the post war period, done both by Paul Bullock,

And by Allin Cottrell, Greg Michaelson and I, has shown

That this effect was a significant cause of falling profit

Rates in the UK in the 3rd quarter of the 20th century.

_________________________

____________________

But you would agree that Sweezy did not have a well

nit theory. Long-run trends must be worked out on the

analysis of real economy not on bubbles and

speculations.Cheers, ajit sinha

I agree that Sweezy did not have a well enough knit theory, but his stuff, ( largely derived from Steindl and Kalecki ) does have worthwhile insights.

This archive was generated by hypermail 2.1.5 : Wed Oct 31 2007 - 00:00:17 EDT